What if the market crashes?

This post is intended for a novice investor.

Introduction

For novices--myself included--one of my main concerns that paralyzed me from participating in the stock market was the fear that my portfolio would crash after I started my investment journey. While this risk is real, I hope with some historical context I can convince the reader that it is manageable.

First, the index funds that I have suggested--either the S&P 500 or a total US stock market--are provide ample diversification, which allows investors to achieve higher returns with lower risk. (There will be those that advocate for further diversification through international stocks and bonds, but this provides a good balance of simplicity and diversification.) This diversification--through the addition of 500 companies in the case of the S&P 500 or over 3700 companies through the total US stock market--reduces the risk of catastrophic downturn within the portfolio.

Historical Context - Great Depression and the Lost Decade

So what is the downside risk? Let's look at a few historical examples, including the Great Depression (1929-1939) and the Lost Decade (2000-2009) which included both the Dotcom Crash (2000-2002), and the Great Financial Crisis (2007-2008).

- Great Depression: If you invested $100 in the beginning of 1929 in the "S&P 500" (or its precursor), you would have $89.45 at the end of 1939, for an annual return of -1.01% per year in this "lump sum" strategy. However, the Great Depression was a rare deflationary environment, meaning this was actually worth $110.04 in real 1929 dollars, or an annual 0.87% per year. Pretty poor returns, but not too awful considering this was the worst decade in US history!

Moreover, if you used a dollar-cost averaging (DCA) strategy in which you contributed monthly to invest throughout this decade, you would have ended up with $93.34, or $114.83 in real 1929 dollars. - Lost Decade: Similarly, if you invested lump sum in the beginning of 2000, you would have a -0.82% p.a. return from the S&P 500 and been essentially even from the total US stock market (-0.06% p.a.). But you would have been up +1.36% in the S&P and +2.24% in the total US stock market if you contributed monthly throughout the decade.

On one hand, the returns provided in these examples are quite discouraging. But on the other hand, these were the two worst decades in the history of the US stock market! Given that the S&P 500 and the U.S. Total Stock Market have returned about 9.2% annually since 1871 and 11.0% since WW2, younger investors with a long-time horizon should feel good about their chances in the stock market.

The Market Has Consistently Delivered Returns Over the Long Run

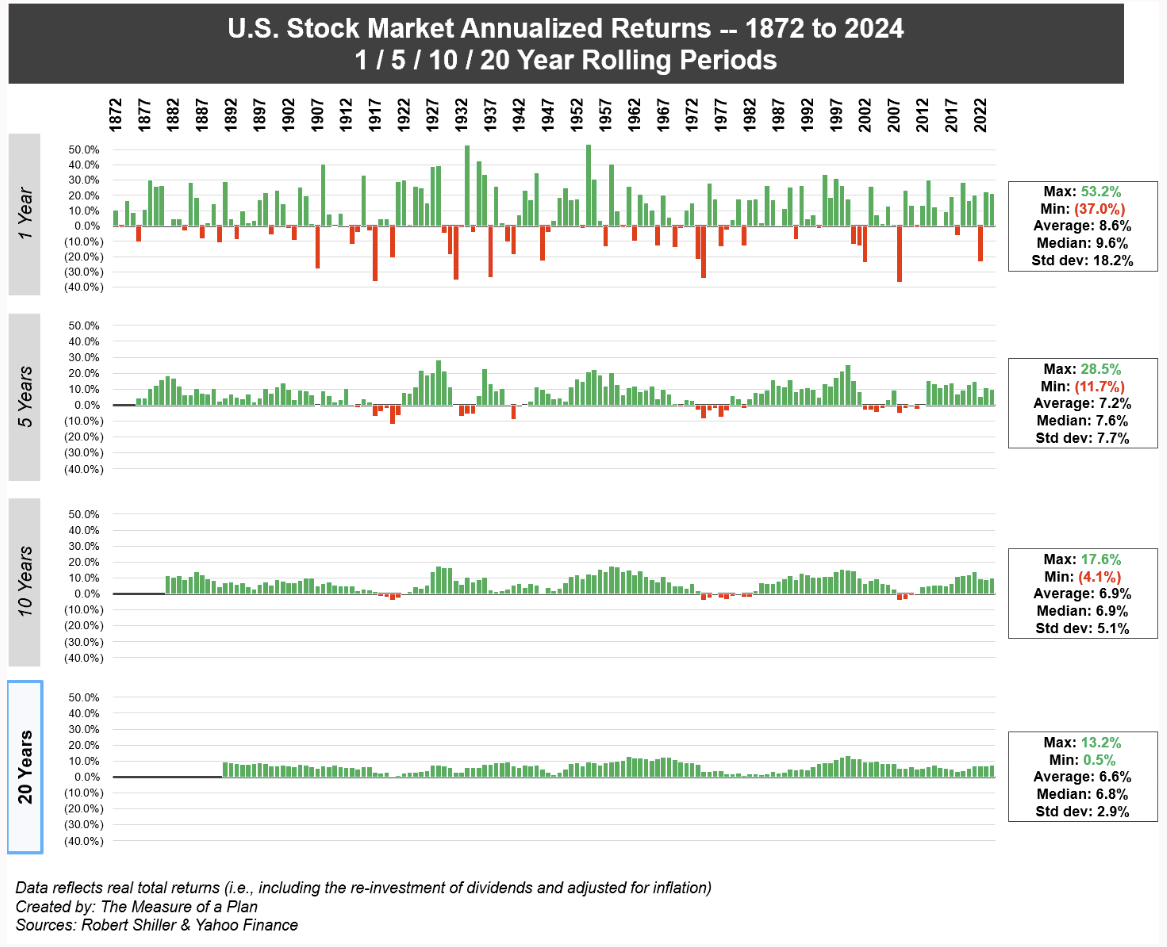

While past performance does not guarantee future returns, on a sufficiently long-time scale, the U.S. stock market has consistently provided positive returns. Shown here are data for real returns (i.e. adjusted for inflation) dating back to 1872. There are years in which returns are negative–sometimes hugely so--but the U.S. Stock Market has never had a 20-year window in which it failed to deliver positive returns in excess of inflation! This is despite two World Wars, a Cold War, two depressions, the Great Recession, two once-in-a-lifetime pandemics, dozens of recessions, and so many other seemingly catastrophic events that seem like mere speed bumps in hindsight.

Time in the Market Beats Timing the Market

If you tune into financial news, you will hear many pessimists ("bears") predict that the stock market will soon crash, often backed with seemingly compelling reasons. However, their opinions contrast with optimists ("bulls"), whose opinions may seem just as compelling. Regardless of where you get these news--legacy media, online sources, financial influences--they are generally attention-grabbing headlines designed to earn your click, rather than to convey a balanced viewpoint. The reality is no one can predict the market with full confidence.

At some point, the bears will be proven right. Bear markets in the stock market occurred, on average, every 5 years. However, the problem from an actionable investment perspective is that is not simply sufficient to predict that a bear market is coming, but you have to be correct on the timing twice--once to exit the market right before the crash, and once to re-enter the market before it recovers.

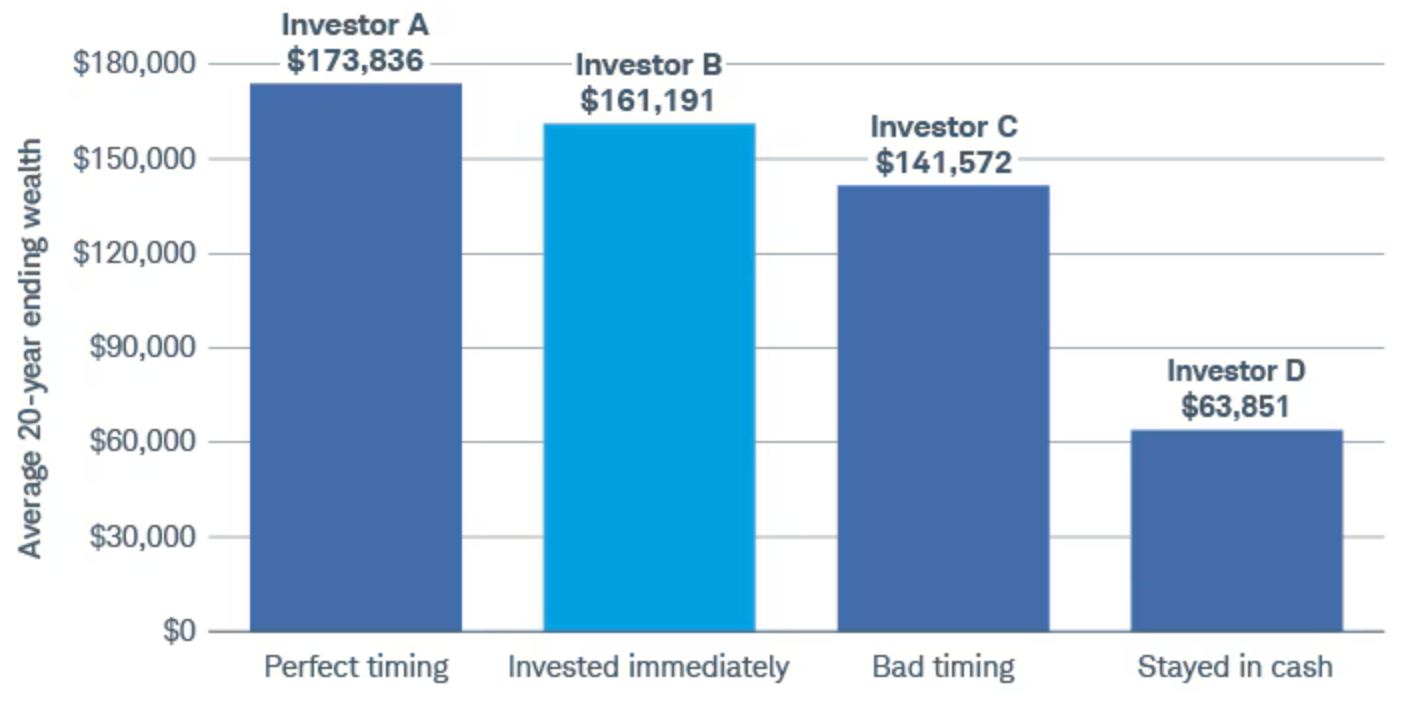

One of the most legendary investors of all-time, Peter Lynch, noted that "far more money has been lost by investors trying to anticipate corrections, than lost in the corrections themselves". He provided an example of three hypothetical investors with unlucky market timing, perfect market timing, and consistent market timing. This has been more recently recapitulated by Charles Schwab in a 2003-2022 backtest, looking at four investors, investing $2000 yearly (total $40000):

- Investor A timed the market perfectly at its lowest point each year.

- Investor B invested immediately on the first day of each year.

- Investor C was unlucky and invested at the highest point each year, but stayed invested throughout.

- Investor D never invested in the stock market, but still kept their money in treasury bills (note that this still beat $40000 in idle cash).

Investor B, who consistently invested, had very similar results to investor A, who timed the market perfectly. Even unlucky investor C trounced investor D, which illustrates the axiom that "time in the market beats timing the market"!